By Sarah O’Brien. Source: cnbc.com

- Parents of boys are more likely to cover the entire cost of college.

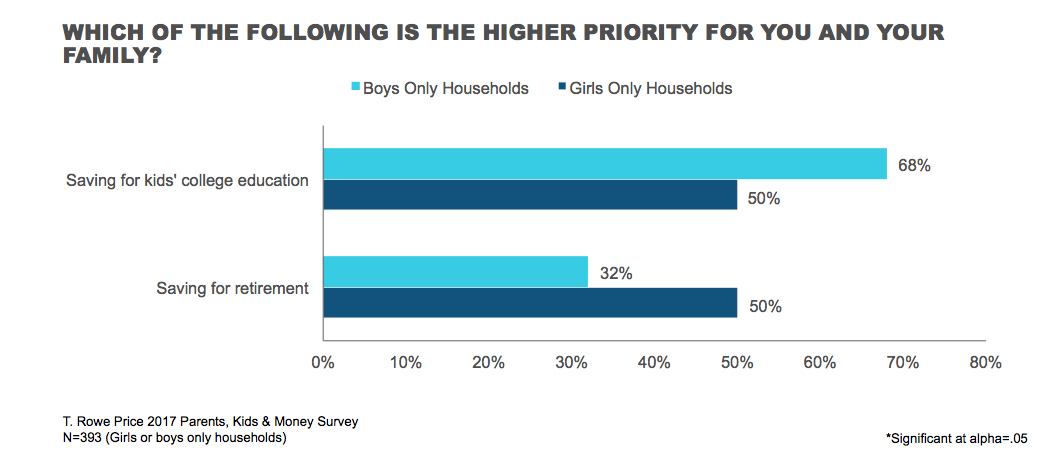

- They also are more willing to prioritize saving for their boys’ college tab over their own retirement.

- If you have daughters, it’s time to do a gut check.

When it comes to college savings for children, it appears parents are no better than bosses who pay their male workers more.

Moms and dads tend to provide more financial support for their sons, a new study by Baltimore-based T. Rowe Price found. Of parents with only boys — whether one, two, or three or more — 50 percent have money saved for their kids’ college compared with 39 percent of parents whose broods are all girls.

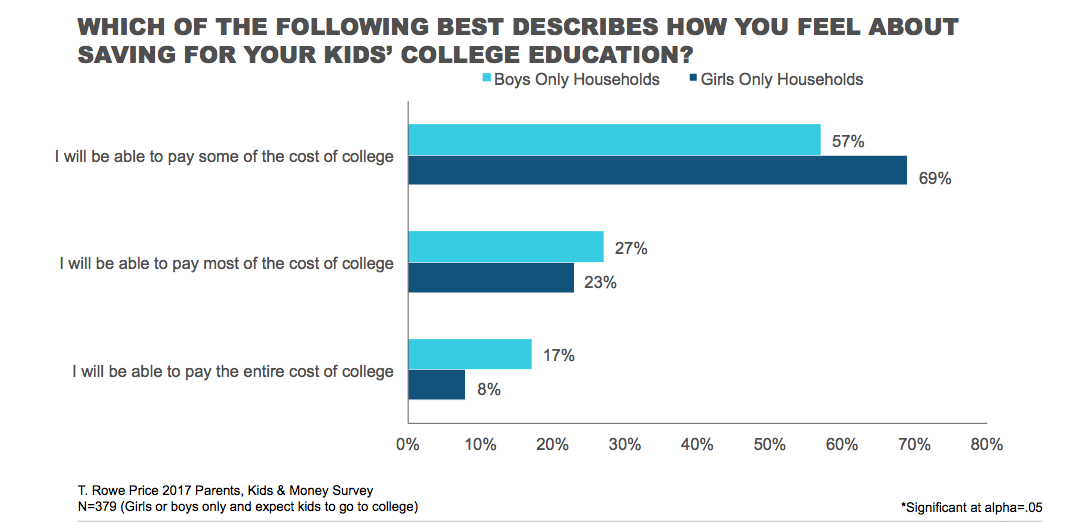

Parents of boys are also more likely to cover the entire cost of college than parents of girls (17 percent versus 8 percent) and less likely to consider sending their male children to a less expensive college to avoid taking on loans. They also are more willing to prioritize saving for their boys’ college tab over their own retirement.

“Looking at the breadth of the results, it suggests there are some antiquated viewpoints on gender out there,” said Roger Young, a senior financial planner with T. Rowe.

The findings were part of the financial services company’s ninth annual Parents, Kids & Money Survey, which was conducted in January and surveyed about 1,000 parents and their children. Although the study does not point to a reason for the disparity — nor endeavor to explain it — the reduced financial support echoes the workplace reality of women earning less.

In 2016, female workers earned 80.5 cents for every $1 earned by their male counterparts, according to Census Bureau data released this month. That amount is a slight increase from 2015, when it was 79.6 cents for every $1.

For parents, the survey results suggest it could be time to do a gut check.

“Just take a hard look at your level of financial commitment and make sure you’re not short-changing your girls,” Young said.

As for putting college savings ahead of your own retirement, regardless of your child’s gender: It’s something that generally makes financial advisors cringe.

“It’s great that parents want what’s best for their kids,” Young said. “But when you’re prioritizing your financial life, it’s important to keep things in perspective and save for retirement. You can’t borrow for retirement like you can for college.”